By Nia Saunders

Financial literacy is the ability to manage and understand one’s personal finances, investments, and anything else that falls within the realm of economic knowledge. Unlike learning to ride a bike, becoming financially literate is not something you can pick up in a day or two. Managing your personal finances can seem like a daunting task to some people (including me) who may excel in other areas, least of all, math.

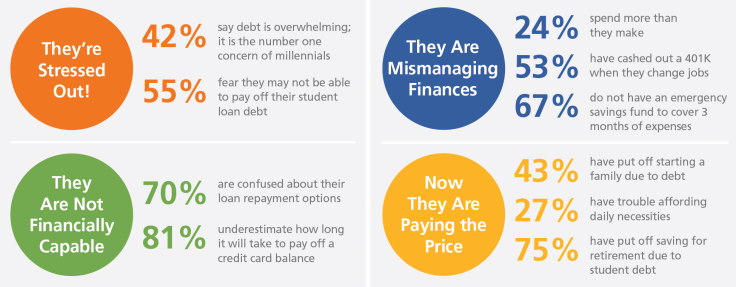

Millennials, out of any generation, could benefit the most from being financially literate. Many of them juggle student loan debt, all while pursuing college or a new career. This lack of financial literacy among millennials can lead to an increase in debt, poor investments and postponed retirement among this generation.

A study from George Washington University found that 8% of millennials said they were comfortable with their knowledge about their own personal finance. Only a quarter of the millennials interviewed said they had a basic understanding of their personal finances.

A study from PricewaterhouseCoopers, an international professional service firm, revealed that almost 30% of millennials have overdrawn their checking accounts and upwards of 80% have at least one form of long-term debt. The study found that millennials frequently rely on future paychecks to cover expenses in the present. Paying for expenditures on credit can be incredibly dangerous financially. This habit is not easy to break and will leave people high and dry if they should face an unfortunate turn of events. Becoming unemployed or medical emergencies can throw off the fragile balance of paying off debt with future earnings.

Caption: This chart contains statistics and responses from millennials from surveys conducted by George Washington University and PricewaterhouseCoopers (PWC).

One’s finances should be carefully planned but still have room for life’s unexpected events. Financial literacy is all about forming habits that will propel you better money managing skills. While researching the conclusions of other surveys, one thing became very apparent: the knowledge gap in millennials’ financial literacy.

The first step towards financial literacy is knowing how to manage money. LaTisha Styles, a personal finance expert, talks about the internal battle in investors between logic and emotion when it comes to making decisions with their money. As an example, Styles described an instance where an investor may feel overly excited when their stocks do well and fail to make a logical decision “based on risk and potential return”. To read more of Styles’ interview with Mint, follow this link: https://www.mint.com/personal-finance-interviews/latisha-on-millennials-and-money

To put it simply, financial literacy is the ability to fully understand how your decisions with money will positively or negatively affect your life. Someone who is financially literate knows how to handle their finances and follow the right steps to benefit them in the future.

Sources:

https://theinvestingmindset.com/become-financially-literate

https://online.maryville.edu/blog/the-trend-of-financial-literacy-among-millennials/

https://turnedtwenty.com/want-future-self-thank-nurture-8-powerful-habits/

Leave a comment