By Nia Saunders

The advancement of modern medicine is no doubt a blessing to society. People are living longer than ever before, but it has created some anxiety among the Baby Boomer generation when it comes to planning for retirement.

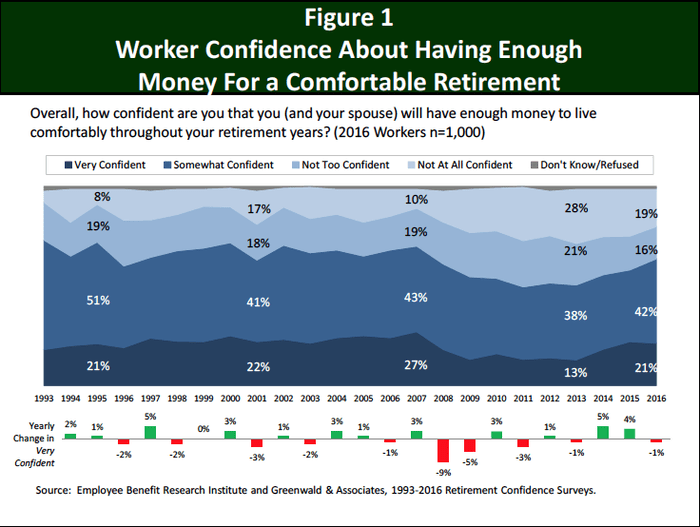

For almost thirty years, the Employee Benefit Research Institute has conducted surveys on how Americans feel towards their own retirement strategies. The results of this survey around the years of the Great Recession in 2008 saw an increase in the percentage of workers who did not feel confident in their ability to retire. Refer to Figure 1 below.

Despite the rise in the confidence level towards retirement, Americans are still struggling to save enough money to retire. Longevity, among other new trends contribute to the retirement crisis. Research from the Insured Retirement Institute concluded that only 23% of baby boomers think they have saved enough money to last through retirement.

As people are living longer, the age requirement for full Social Security benefits have risen as well. Before 1983, the age to receive full benefits was 65. Now, those who wait until they are aged 70 qualify for the maximum retirement benefit, which is $3,538 a month.

In addition to Social Security, other savings are required to cover the cost of living comfortably during retirement. In the past, these savings would usually come from retirement plans sponsored by an employer, also known as a 401(k) plan. Since 1999 Americans have seen a decline in retirement plans offered by their employer. A staggering 53% of workers receive the benefit of an employer sponsored retirement account. This is partly due to the growing trend of people working as independent contractors and working for a small business. Contingent jobs refer to those in which are not permanent, such as seasonal positions and contractors. This trend has grown within the workplace and prevents employees from having benefits that a Union member employee would receive.

There are opportunities for freelance workers to establish a solo 401(k), but it is often overlooked. People who feel uneducated in creating a retirement account for themselves will often avoid it, or open one much later when it is brought to their attention. This group had a meager 13% participation rate in opening retirement plans, as opposed to the 83% participation rate of workers who have 401(k) accounts sponsored by their employer.

The Baby Boomers are also facing a technological epidemic within the work force. Much of the older generation, especially those with manufacturing positions, are not able to continue to work because of the new use of automation in these jobs. It is also difficult for them to remain in jobs that are physically demanding.

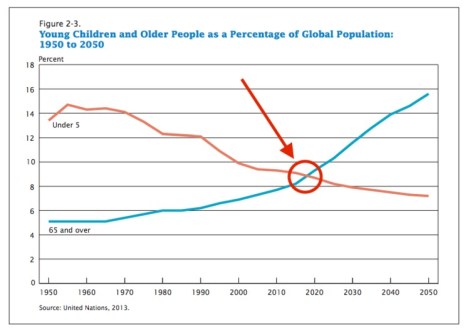

Life expectancy is projected to see an incline while birthrates will decline, this is a global phenomenon, and will create another issue for those who are retiring and expecting to retire soon.

The number of elderly adults retiring will outnumber those who are eligible to join the workforce and decrease the amount of people who are able to support their retirement.

These factors have created the growing epidemic of the retirement crisis in America. Maintaining a steady savings account throughout your life can solve some of the financial burden you could face during retirement. Keeping these issues in mind, with enough preparation, a comfortable life during retirement is impossible. Start saving early is the key, and you can experience all the benefits of life after your working years.

Sources:

https://www.nasi.org/learn/socialsecurity/retirement-age

Sources for the graphs:

https://www.businessinsider.com/retirement-crisis-baby-boomers-living-too-long-2017-11

Leave a comment